Banking without fees.

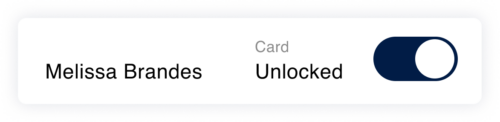

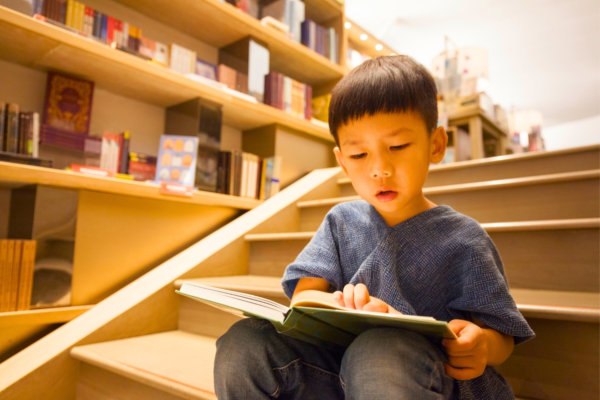

Youth Accounts

Fee-free is for everyone — start your family’s financial journey with an Amplify youth deposit account or a Greenlight debit card on us*.

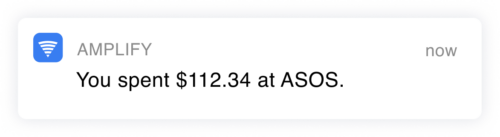

Goodbye To Fees

Our goal is to remove the obstacles that stand between our members and financial success, so we turned off all of our bank fees. Because it’s not just about giving back – sometimes, it’s about not taking in the first place.

|

|

Other Banks |

|

|---|---|---|

| Monthly Maintenance | $0.00 | $13.951 |

| Overdraft Fees | $0.00 | $30.821 |

| Out-of-Network ATM Fees | $0.00 | $1.511 |

| Wire Transfer Fees | $0.00 | $26.001 |

¹Based on data from Bankrate and MoneyRates.

Free overdraft programs

Amplify offers two free overdraft programs to our members that are both designed to add an extra level of protection to your transactions. Use the link below to learn more about both our fee-free overdraft programs.

Anything we can answer?

What does membership require?

How does overdraft protection work?

How can Amplify afford to go fee-free?

What about ATM fees?

Can I see the full list of bank fees?

Are there any hidden banking fees?

¹The term bank fees refers to any fees associated with the operation of personal or business deposit accounts. This includes savings accounts, checking accounts, certificates of deposit, and money market accounts. Bank fees does not refer to personal, commercial, or real estate loan products, or to third-party services offered through Amplify (such as wealth management or credit card services).

*Amplify Credit Union members are eligible for the Greenlight SELECT plan at no cost when they connect their Amplify Credit Union account as the Greenlight funding source for the entirety of the promotion. Subject to minimum balance requirements and identity verification. Upgrades will result in additional fees. Upon termination of promotion, customers will be responsible for associated monthly fees. See terms for details. Offer ends 6/24/2026. Offer subject to change and partner participation.

Please refer to the Share Account Rate Disclosure, Certificate Account Rate Disclosure, and Beneficial Owner Disclosure for further information relating to the above products. See Business Fee Schedule & Rate Schedule for current rates and fees.