How to Use Compound Interest to Your Advantage

When it comes to personal finance, making the most of your money is essential for long-term financial security. One powerful tool that can help you grow your savings over time is compound interest.

By understanding how compound interest works and implementing smart saving and investment strategies, you can harness the power of compounding to build a more secure financial future. So let’s dive into the world of compound interest and discover how it can work in your favor when it comes to interest-bearing savings and checking accounts.

Talk to a CFS* Financial Advisor

Want to take your retirement plans to the next level? Schedule a Amplify Wealth Management appointment with our colleagues at CUSO Financial Services (CFS).

What is compound interest?

Interest is a fundamental concept in the world of finance that plays a crucial role in both borrowing and investing.

- In borrowing, interest represents the cost of using someone else’s money or the fee charged by a lender for providing funds. When you borrow money, the lender typically charges interest on the amount borrowed. This interest is essentially the price you pay for the privilege of using the lender’s funds.

- In saving and investing, interest refers to the additional money earned on top of the original amount deposited or invested. When you save money in an interest-bearing savings account or investment instrument, the financial institution or issuer pays you interest as a reward for keeping your funds with them.

There are two types of interest: simple interest and compound interest.

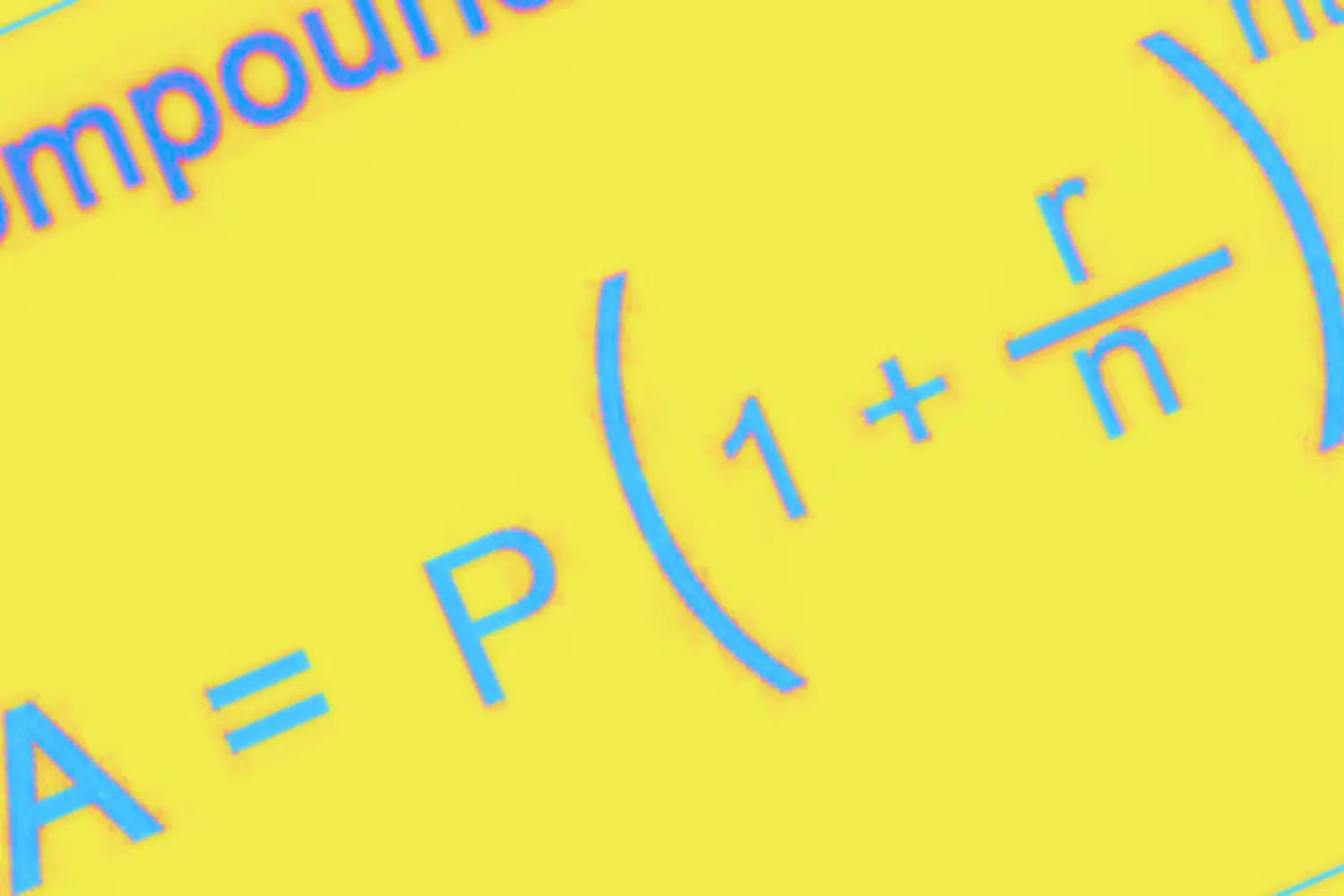

Compound interest is a powerful financial concept that can help your money grow over time.

Unlike simple interest, which is calculated only on the initial amount of money invested or deposited, compound interest also takes into account the accumulated interest. This means that over time, you earn interest on your original deposit AND the interest you’ve already earned.

The longer you keep your money in an account that compounds interest, the more significant the impact of compounding becomes. Over time, compounding can generate substantial growth, allowing your savings to snowball and work for you. It’s like a financial snowball effect, where the growth of your money starts to accelerate and build momentum.

How does compound interest work?

When you deposit money into an interest-bearing deposit account, the bank or financial institution pays you interest on the money you keep in the account. Interest rates are typically expressed as an annual percentage (APY) such as 2%, 3%, or higher. The frequency at which the interest is compounded varies between different accounts and can be annually, quarterly, monthly, or even more frequently.

Compound Interest Example

Let’s consider an example to illustrate how compound interest works in a savings or checking account.

Imagine you have $5,000 deposited in a savings account with an annual interest rate of 4% compounded annually. At the end of the first year, you would earn $200 in interest, bringing your total balance to $5,200. In the second year, the interest is calculated based on the new total balance of $5,200, resulting in $208 in interest. The process continues, and each year the interest compounds on the new balance, gradually accelerating the growth of your savings.

The power of compound interest becomes more apparent the longer you keep your money in the savings account. With each compounding period, the interest earned is added to your principal, creating a larger base on which future interest calculations are made. Over time, this compounding effect can lead to significant growth in your savings, even if you don’t add anything to the account.

Rule of 72

You may have heard about the “Rule of 72” when it comes to compound interest.

The rule of 72 is a quick rule of thumb for estimating the time it takes for an investment to double in value based on the rate of compound interest. By dividing 72 by the interest rate, you can approximate the number of years it would take for the investment to double.

For example, if you have an investment with an APY of 6%, using the rule of 72 tells you that it would take approximately 12 years for the investment to double in value (72 divided by 6 equals 12).

This rule provides a quick and easy way to assess the potential growth of an account and make informed decisions about long-term financial planning. However, it’s important to note that the rule of 72 is a simplified approximation and may not be precise for all interest rates or investment scenarios.

Strategies to Leverage Compound Interest

To make the most of compound interest and maximize the growth of your savings, implementing smart strategies is essential. By following these strategies, you can harness the power of compounding and set yourself on a path to financial success.

1. Start saving early.

The earlier you begin saving, the longer your money has to compound and grow. Even small contributions made consistently over time can accumulate into significant savings due to the compounding effect.

2. Increase your savings rate.

Whenever possible, allocate a larger portion of your income toward savings. By increasing your savings rate, you not only contribute more to your account but also increase the potential for higher interest earnings.

3. Take advantage of high-yield savings accounts.

Explore options for high-yield savings accounts that offer competitive interest rates. These accounts can provide a higher return on your savings compared to traditional savings accounts, boosting the impact of compound interest.

4. Consider the effects of compounding periods.

Some savings accounts compound interest more frequently than others. While annual compounding is common, accounts that compound interest quarterly or monthly can lead to faster growth. Compare the compounding periods offered by different accounts and consider choosing one with more frequent compounding for enhanced results.

5. Explore the benefits of reinvesting interest earnings.

Rather than withdrawing the interest earned, consider reinvesting it back into the savings account. By reinvesting, you increase the principal amount on which future interest calculations are made, amplifying the effects of compounding.

Exploring Other Compounding Investments

While our primary focus has been on interest-bearing deposit accounts, it’s worth mentioning that the concept of compound interest also applies to investment vehicles such as stocks, bonds, and mutual funds.

These types of investments have higher earnings potential— but there are also additional risks involved. Keep in mind that historical performance is not indicative of future results, and it’s crucial to approach investments with caution and always seek professional advice.

Leverage the Power of Compound Interest

Compound interest is a powerful financial tool that can work to your advantage when it comes to growing your savings over time. By understanding the principles of compound interest and implementing smart strategies, you can set yourself on a path to financial success.

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA/SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. (Amplify Credit Union) has contracted with CFS to make non-deposit investment products and services available to credit union members.

Talk to a CFS* Financial Advisor

Want to take your retirement plans to the next level? Schedule a Amplify Wealth Management appointment with our colleagues at CUSO Financial Services (CFS).