Bank Fees Are Broken

When Amplify made the switch to fee-free banking in 2022, I knew that what looked like a change in product features to some was going to become a moral crusade for me. That’s why I’ve spent the past year talking to anyone who would listen about the discriminatory nature of bank fees. But when I describe the current state of banking as irreparably broken, I almost always hear from someone who can’t remember the last time they paid a fee to their bank. If they are earning money from their savings account every year, doesn’t that mean that everyone can?

It’s a fair question, so let’s talk about what savings and checking accounts really do for the average American.

The narrative around interest rates and bank fees has always been that banks exist to help you grow your savings, but you might get charged the occasional fee if you do not manage your money carefully. To hear banks describe it, bank fees are not a systemic issue – they are simply a lesson in personal responsibility, and most people can avoid fees if they make smart decisions with their money.

It’s a message that celebrates that old cliché of the self-made American. It’s also incredibly misleading.

What is true is that most Americans pay nothing in bank fees. According to BankRate, 73% of Americans do not pay a single bank fee each year. But while some might argue that this means the system is working, what it actually means is that a small minority of Americans are footing the bill for billions and billions of dollars in bank fees every year. In fact, the New York Times estimates that just 9% of account holders pay 80% of all overdraft fees.

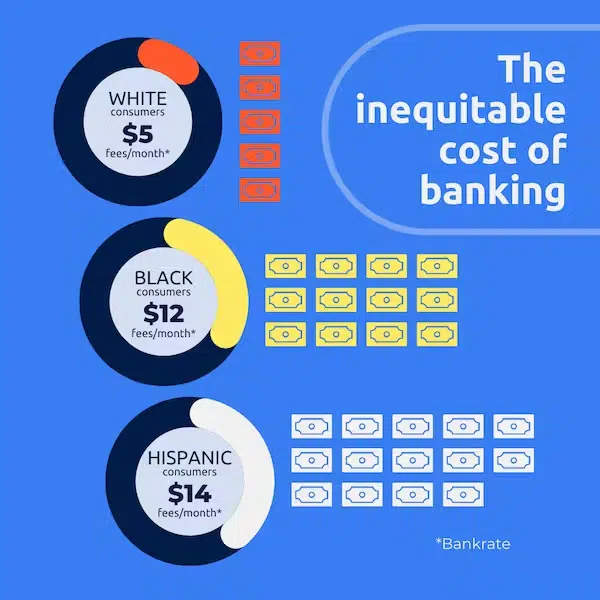

So who is left on the hook? Too often, the answer is people of color and younger generations.

Studies show that Black and Hispanic audiences pay over two times as much in monthly fees as their White counterparts. When you compare these numbers to the overall racial wealth gap in America – where household wealth for White consumers is increasing while household wealth for Black and Hispanic audiences is declining – you see yet-another system that seems to be working differently for different parts of America.

But when we break bank fees down by generation, the numbers become even more bleak. Earlier this year, Amplify ran the numbers on our membership using industry data. We took average deposit balances from actual members and used those numbers to calculate the annual interest earnings based on the current national average interest rate. We then compared that to a 2022 Bankrate study that projected fee incomes based on generations.

| Audience | Annual Fees¹ | Balance² | Interest Income³ | Difference |

|---|---|---|---|---|

| Gen Z | $228.00 | $4940.00 | $11.36 | -$216.64 |

| Millennials | $192.00 | $5,390.00 | $12.40 | -$179.60 |

| Gen X | $48.00 | $11,650.00 | $26.80 | -$21.20 |

| Baby Boomers | $24.00 | $28,084.00 | $64.59 | $40.59 |

Now, you can tinker with these numbers if you want – plug in different fee estimates based on different studies or choose a higher interest benchmark using industry-leading banks – but the overall results will remain the same. If Amplify had continued the approach of our peers, the average Gen Z or Millennial member would pay more in fees than they earned in interest. In essence, we would be taking money from people with smaller balances and giving it to those with the biggest balances. There are a lot of words you could use to describe a system that works like that, but “equitable” is not one of them.

“We will continue to lead by example for those who want to do better by their customers.”

Of course, bank fees are just one small piece of the puzzle when it comes to building wealth for members of our community. But this is one area where banks can make an immediate impact to return billions of dollars back to the people they serve. It shouldn’t be a radical idea that your savings account should be a safe place to keep your money, but we will continue to lead by example for those who want to do better by their customers.

So sure, if you already have a lot of money, then the current state of banking is probably working very well for you. But odds are that someone in your life – a child, a friend, a member of your extended family – is one of those Americans losing money to their bank every year. And I hope that’s enough to convince you to join us as we build an approach to banking that works for everyone.